Calculate depreciation deductions for any investment property

Easily forecast the after tax cash flow from an investment property with the BMT Tax Calc app.

The BMT Tax Calc app helps property investors, Accountants, Real Estate Professionals and Mortgage Brokers to estimate the likely tax depreciation deductions on any investment property.

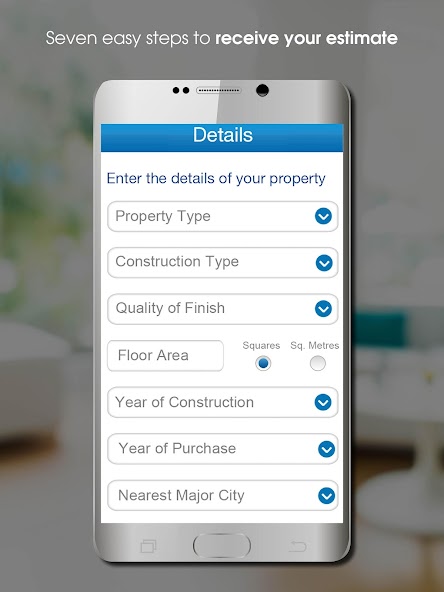

The comprehensive app helps estimate depreciation deductions for a range of different property types including:

• Standard houses

• Architecturally designed houses

• Townhouses

• Units and apartments

• Bulky goods centres

• Office developments

• Industrial metal or concrete clad

Estimate claimable deductions within seconds.

Learn more about BMT Tax Depreciation:

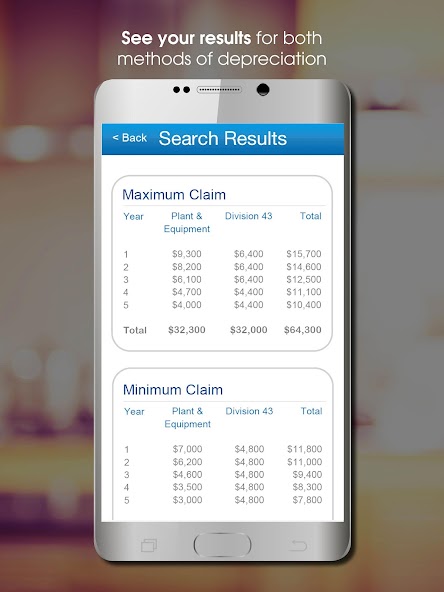

BMT Tax Depreciation specialise in maximising depreciation deductions for property investors Australia-wide. The Australian Taxation Office (ATO) allows investment property owners to claim a deduction related to the building and the 'plant and equipment' assets contained within it. Depreciation can be claimed by any owner of an income producing property. This deduction essentially reduces taxable income for investors – they pay less tax.

Every investment property should have a tax depreciation schedule completed to unlock its full cash flow potential. Property owners could be saving thousands of dollars every year. To learn more about property depreciation or to request a quote visit our website at www.bmtqs.com.au